Predict the future, and you can optimize your business.

How?

By leveraging revenue forecasting models.

Revenue forecasting lets you see what’s ahead in revenue so you can make data-driven decisions to grow your business.

Relying on revenue forecasting can help you analyze your revenue situation holistically to make the right decisions at the right time. It considers internal and external factors that can help or harm your company’s revenue so you can level up.

In today’s fast-paced world, you must stay on top of your revenue game to stay competitive.

In this guide, we’ll break down the main revenue forecasting models, how to use them to grow your business, and the top tools to get your team up to speed.

Table of Content:

- What are revenue forecasting models?

- What are the benefits of using revenue forecasting models?

- What are the different types of revenue forecasting models?

- 4 Best practices for implementing and using revenue forecasting models

- Top tools for revenue forecasting models

- How Clari can help you grow your revenue

What are revenue forecasting models?

Before we dive into revenue forecasting models, let’s back up a bit.

What exactly is revenue forecasting?

Simply put, it predicts your company's total revenue during a specific period. This usually means looking into the next month, quarter, or year.

How does it work?

Revenue forecasts analyze several different data points to make informed revenue projections in your business.

This can include looking at data like:

- Pipeline data

- Competitor data

- Greater market demand

- Historical performance data

While sales forecasting is similar, revenue forecasting looks at the total overall revenue you are likely to generate rather than individual sales.

How you interpret this data depends on the revenue forecasting model you choose. While every business has similar data points, what matters for your business will determine your selected model.

Every organization will use a different forecasting model or a combination of a few models.

What are the benefits of using revenue forecasting models?

Revenue forecasting models aren’t just the right thing to leverage because your competitors use them.

Several business benefits will help you improve your revenue and grow long-term:

Accurate budgeting

The most important benefit to revenue forecasting is improved financial health.

When you can accurately predict how much money you can expect to generate from future sales, you can support your budgeting process and improve your cash flow.

How?

If you know you’re likely to receive an additional $130,000 in revenue next month, you can potentially spend more on equipment, resources, or marketing to help grow your business.

Conversely, if you predict revenue will drop by $75,000 next month, you may want to hold off on that major purchase.

Operations optimization

Forecasting also helps you optimize your different teams.

Within sales, you can improve:

- Quota setting

- Capacity modeling

- Territory assignments

- Compensation planning

Your marketing team will be able to improve budgets for new campaigns and promotions rather than spend amiss.

Additionally, your HR department can gain insights into hiring new staff or pulling back based on future revenue.

Reach new revenue targets

The most exciting part of revenue forecasting is you’re empowered to reach new revenue targets.

How?

Let’s say you know your revenue typically dips in September. Instead of accepting that fate and conducting business as usual, you can strategically plan a campaign to boost September revenue.

This means you can reach new monthly, quarterly, and annual targets by knowing what’s ahead.

Pique investor interest

Launching a new campaign is one way to grow revenue with forecasting.

Another big move is gaining investor interest.

With better forecasting, you can better predict profitability.

And, if you’re looking to grow, one key method is by securing funding. When you can prove to investors that your revenue horizons are promising, you’re more likely to get them on board, which can supercharge your business growth.

What are the different types of revenue forecasting models?

Now that you understand why you need to implement revenue forecasting, it’s time to analyze the different methods.

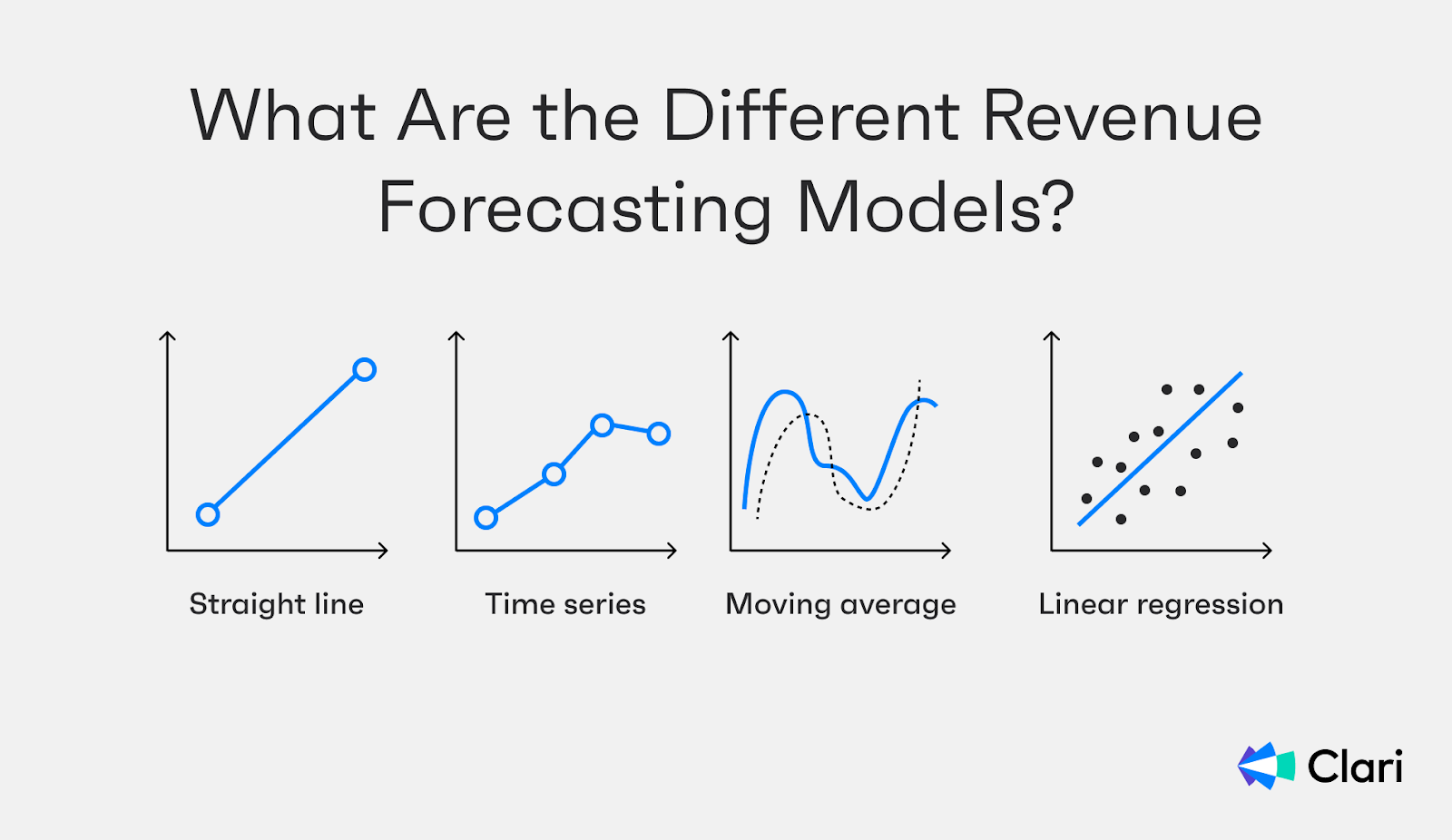

Here are four types of revenue forecasting models you can use to predict future revenue:

Straight line

If you want to start with a simple forecast, a straight line is the way to go.

Straight line revenue forecasting relies on historical data to predict future company growth. It analyzes past performance, assuming your company will continue to grow steadily and consistently.

For example, if you look at the past ten years and your company averaged a 7% year-on-year growth, a straight line will assume you will continue growing by 7% yearly.

This is a reliable model if you’re in an established industry and have more stable market conditions.

Moving average

Most companies don’t typically have the same growth rate each year.

So, they need to rely on a moving average forecasting model.

Like straight line forecasting, moving averages rely on historical data. Instead of looking at longer-term trends, it analyzes shorter time intervals to discover market trends.

This forecasting model pulls on moving average data to target fluctuations in sales over different time periods.

For example, your historical data shows you typically get a 15% lift in sales during November and December compared to the rest of the year. In this instance, moving average forecasting will take note of this seasonal trend to add it to the forecasting method.

This method is best for businesses with seasonality. This will help you account for yearly fluctuations to make better revenue intelligence decisions.

Time series

Like the first two forecasting methods, time series analyzes historical data to forecast future revenue. But, unlike the others, it doesn’t look at longer periods of time. It analyzes specific time intervals:

- Months

- Quarters

- Years

Time series helps you analyze specific time pockets every single year. For example, if you have cyclical revenue models (i.e., SaaS), you’ll likely want to use time series to predict revenue.

You can better understand future fluctuations and plan campaigns and resources to maximize revenue by looking at specific time frames.

Linear regression

The fourth most popular revenue forecasting model is linear regression.

This approach considers two variables to analyze future growth.

In most cases, profits and sales are the most common variables analyzed in linear regression. By studying how these two variables intertwine, you can accurately forecast revenue growth (or decline)

For example, if your sales are growing, but your profit is slipping, it could indicate that your gross margins need to be optimized. In this scenario, you may need to adjust your growth levers, resource allocation, or pricing.

4 Best practices for implementing and using revenue forecasting models

While forecasting revenues is beneficial to help grow your business, it’s no walk in the park.

Here are a few best practices you should follow to ensure you get it right:

Ensure you have accurate data

If your data isn’t accurate, you’ll miss the mark with your revenue predictions.

To maintain accurate forecasting data, you need to rely on the right revenue forecasting software to ensure you don’t miss a beat.

Clari can help you by providing accurate data and robust forecasting. The platform automates many forecasting processes allowing you to accurately predict future revenue and make better decisions.

Learn more about Clari forecasting.

Get everyone on the same page

If you want your organization to thrive, you need to ensure everyone’s on board.

This means appointing a leader or even an entire forecasting team dedicated to leading the way. Ensure your revenue forecasting leadership is meeting regularly and providing support to other team members like finance managers, sales managers, sales reps, operations managers, and more on a regular basis.

Regularly update your forecast

Your revenue forecasts rely on a consistent stream of new data. You won't have accurate forecasts if you aren’t updating the data or analyzing your forecasting methods.

Check your forecasting once per month or quarter to ensure it’s accurate and updated to align with your revenue goals.

Don’t rely on the forecast too heavily

Revenue forecasts can be a great help in strategizing your business. But forecasting isn’t a crystal ball.

As much as they can help you predict revenue and make better decisions, they shouldn’t be relied on too heavily.

You should ensure you’re spending time on the fundamentals to grow your business, such as training sales teams, implementing marketing campaigns, and improving your product to maintain future revenue.

Top tools for revenue forecasting models

You need to rely on the right tools to get the most out of your revenue forecasting strategy.

Here are a few revenue forecasting tools that can help take some of the weight off your shoulders:

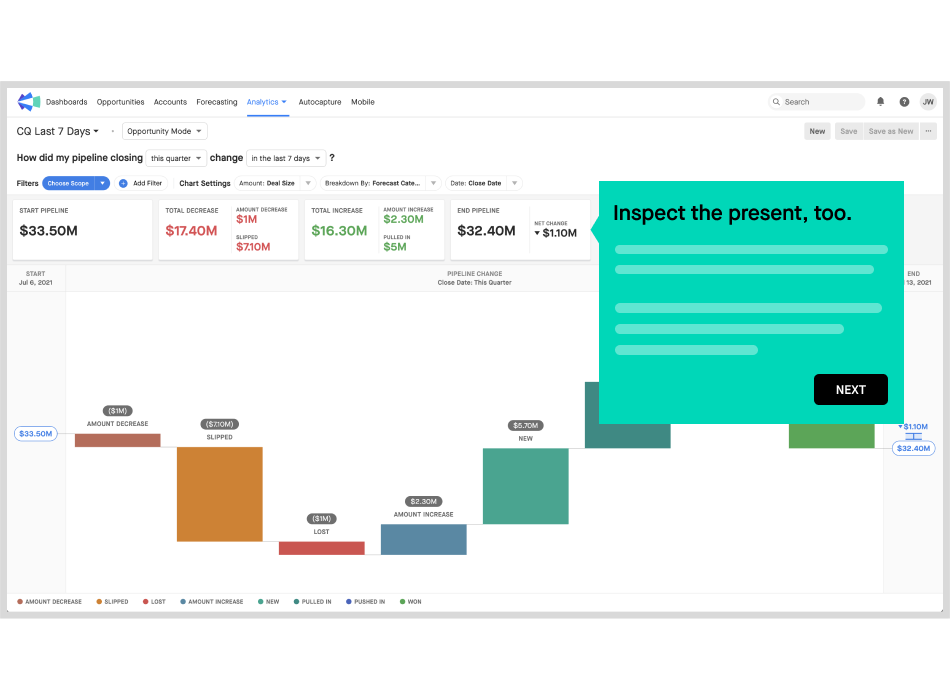

1. Clari

Clari is one of the best revenue intelligence platforms on the market. A key part of their software is revenue forecasting.

Key features include:

- Automating dozens of forecasting processes

- Enabling you to create complex and insightful forecasts

- Robust variable tracking

- Powerful inspection tools

- Accurate forecasts via rollups

2. Zendesk

Zendesk Sell is a sales platform with various forecasting tools to help you predict revenue.

Key features include:

- Sales forecasting

- Win probability forecasting

- Reports on forecasted sales by source

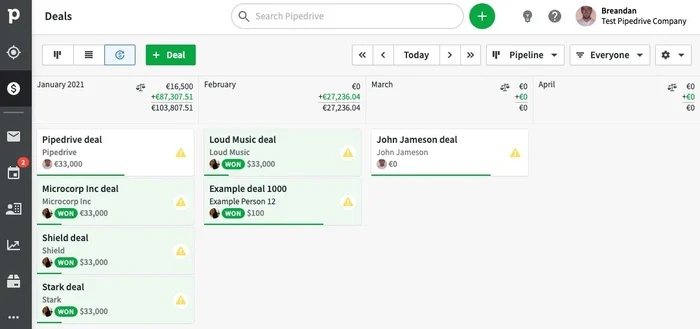

3. Pipedrive

Pipedrive has a revenue forecasting tool that uses AI and automation to predict revenue.

Key features include:

- Visualized deal progress

- Drag and drop functionality to close deals

- Deal probability configuration

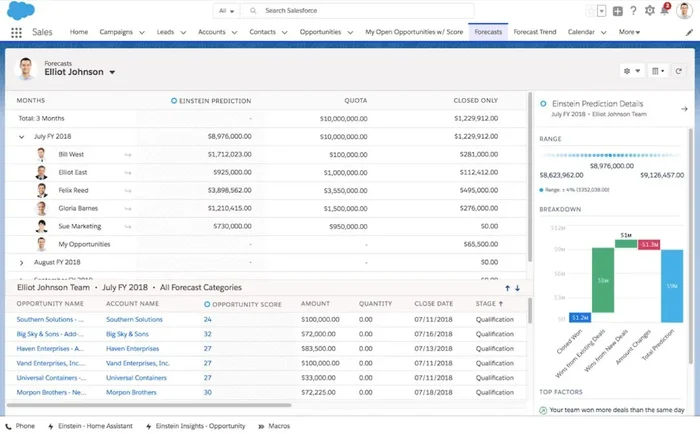

4. Salesforce

Salesforce has a sales automation tool called Sales Cloud that relies on sales data, AI, and automation to help improve your revenue operations.

Key features include:

- Product families in forecasts

- Switch between four different sales forecast models

- Leverage AI to improve forecasting accuracy

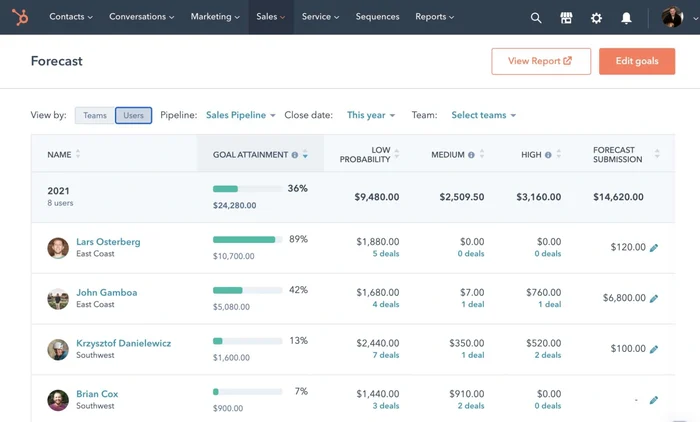

5. HubSpot

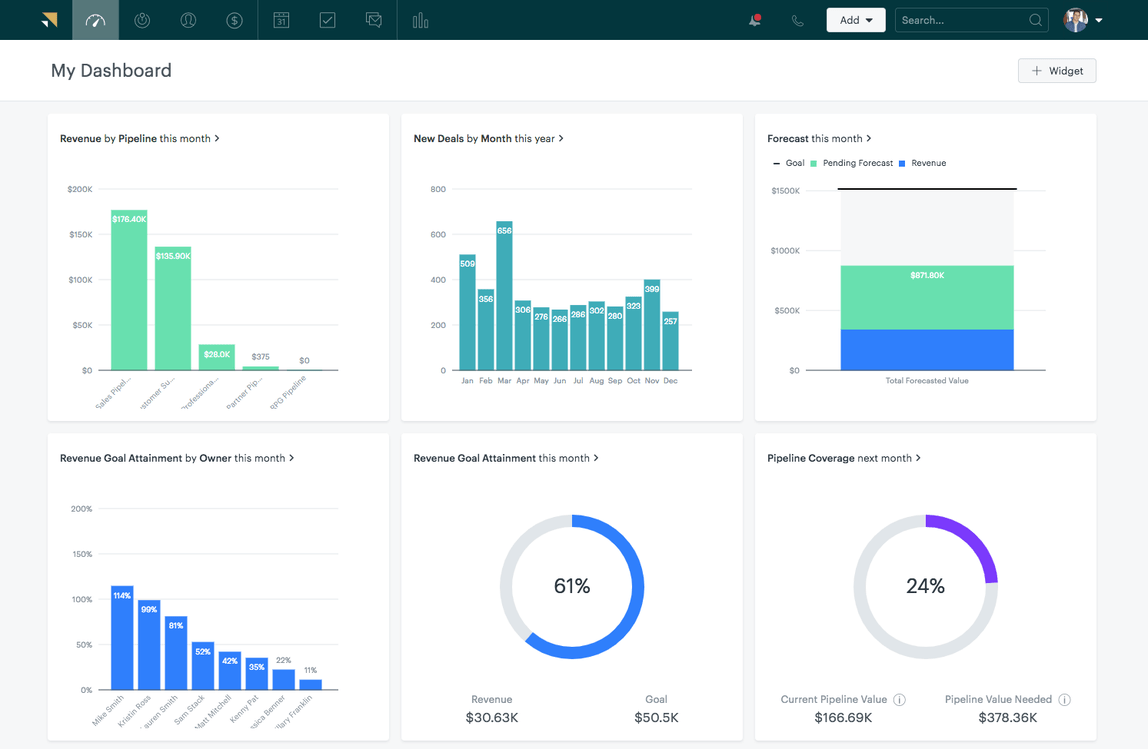

HubSpot Forecasting helps sales and revenue teams manage their sales pipeline and forecast revenue.

Key features include:

- Deep dives into individual pipelines and forecasts

- Pull data directly from HubSpot CRM

- Mobile app to track forecasts on the go

How Clari can help you grow your revenue

If you want to grow your revenue, you need to have the right strategy.

With revenue forecasting models, you can strategize based on future revenue growth (or decline).

No matter your revenue forecasting model, you need to ensure you’re leveraging the right software.

Clari can do the heavy lifting by providing accurate data capture, analytics, and reporting to help you make informed decisions every month.